Once a readily available investment option, seasoned MBS’s are becoming increasingly scarce in the secondary trading arena, especially those with a par value in excess of $1MM.

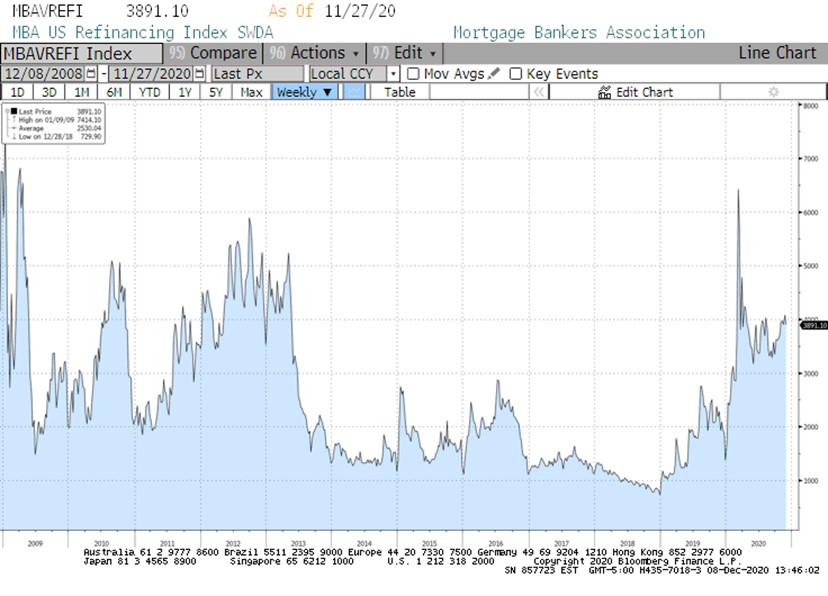

True to form, 2020 closed out the year with record low mortgage rates. As such, homeowners are refinancing at a pace not seen since the financial crisis of 2009, and investors are seeing principal balances of MBS’s evaporate at record rates, both in their own portfolios and in the secondary market.

I’ve been concerned about this trend and its resulting impact on investment opportunities in MBS’s for some time now. As the MBS Specialist at SB Value, I recently received a request for an MBS PT (Mortgage Backed Security Pass Through) with very specific features. The investor set tight specifications for years to maturity, average life years, WAC (weighted average coupon), FMED rating, number of loans in the pool, CPR (Conditional Prepayment Rate) and, of course, yield.

It was a challenging request. Not just because of the investor’s specifications, but due to the dwindling supply of high par value MBS’s available for secondary trading. Consider the following:

As the above figure indicates, the 2020 Refinancing Index was the highest since 2009 and was double that of the average annual volume relative to the past six years. The result—the once high par value pool of MBS’s is rapidly diminishing.

So, what are the investment implications for financial institutions? Let’s look at it from a buy, hold, and sell perspective…

When buying, consider two points:

When holding, be aware of the expected rate of prepayment, the potential for decreased returns in your existing portfolio, and the resulting surplus of funds that will need to be reinvested. There are two primary prepayment rates published for collateralized securities. They are as follows:

When selling, keep the following two points in mind:

The diminishing supply of high par valued MBS’s is just one of many factors we consider when providing investment advice on behalf of our financial institutional partners. If this is an area you need to explore further, please reach out to see how we may be of assistance.

”

ABOUT THE AUTHOR

Leslie Heath, Vice President – MBS Specialist

My true passion is sailing. Having spent my childhood living abroad in France, Germany, Libya, and Italy, we finally returned to the states when I was in my early teens. You would think that once we settled back home that I would never again leave solid ground, but I took to the water at 14 years old and have been there ever since. Many weekends are spent enjoying the calm waters, a seasonal breeze, and the setting sun.

With 35 years of extensive experience as a fixed income trader, I’d like to say that I started at age 14, as well, but alas, that is not the case. During those years, I developed a diverse investment background and currently specialize in mortgage related securities: MBS’s, CMO’s, ABS,’s, CMBS’s, ACMBS’s.

Being in the industry for so many years, I’ve had a front row seat for every ebb and flow of the market, and I find that there are many similarities between sailing and market cycles. Sometimes the wind is to your back, the waters are smooth, and it feels like it will never slow down. Other times its choppy, erratic, and unpredictable. As both a fixed income trader and an avid sailor, I find it’s best to be prepared for the unexpected, maintain a standard of excellence, and keep an eye on the horizon.