Summary: Sequential occurrences needed to happen to confirm a possible normalization of rates. It seems that they may have begun to occur and now their direction needs to be confirmed. One of the questions now is what parts of portfolio should be moved into the HTM camp from AFS.

An Important Upcoming Fed Event: Attend this complementary Quarterly Fed & Market Call to round out this article. Especially after this weeks market moves. Speaker Dr. Ed Seifried. Tuesday, February 1st. Find out more here & RSVP.

In a normal order of operations, 2022 has begun with a NASA like event – hence, we have liftoff, and the year has begun in spectacular fashion.

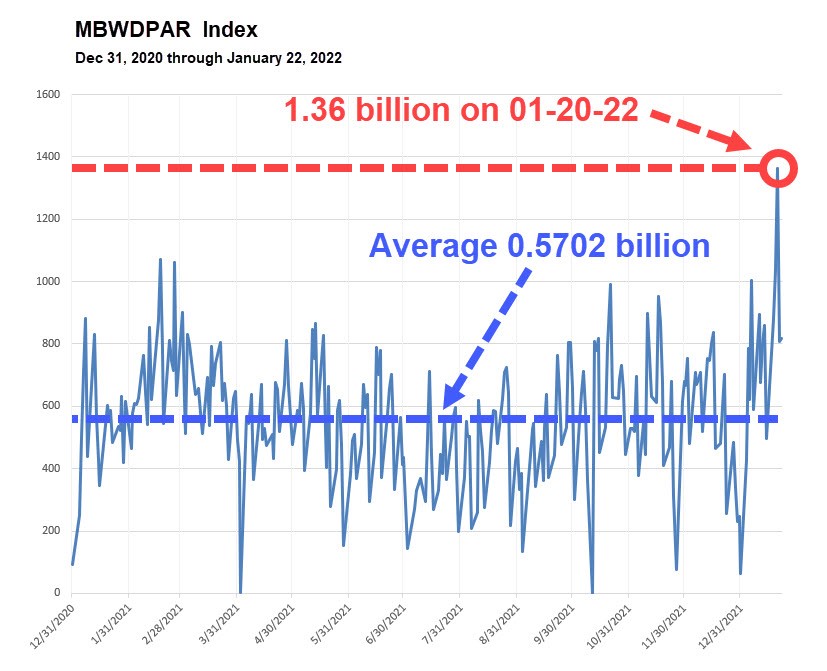

Investors put the highest amount of municipal bonds out for bid since April 2020 as state and local-debt market head for their worst month in nearly a year, according to a Bloomberg index. The total par amount of bonds out for bid on MBWD surged to over $1.35 billion on Jan. 20.

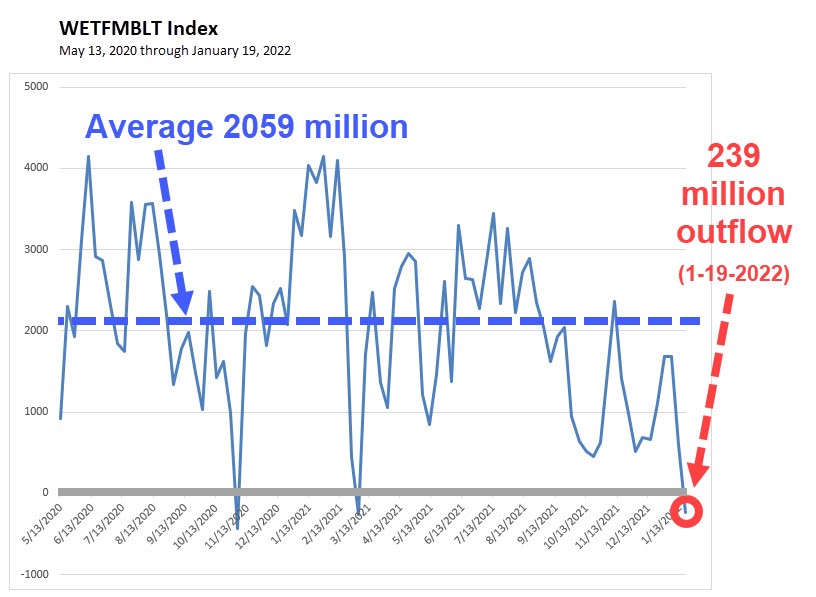

Muni mutual funds saw $239 million withdrawn during the week through Wednesday, ending 45 weeks of gains, according to Refinitiv Lipper US Fund Flows data. Related:Muni-Bond Buyers Flee Mutual Funds in First Outflow Since March. Munis have posted a 1.42% loss this month (as of 01-24-22), on track for the worst monthly performance since February 2021 using the S&P National AMT-Free Municipal Bond Index as the gauge.

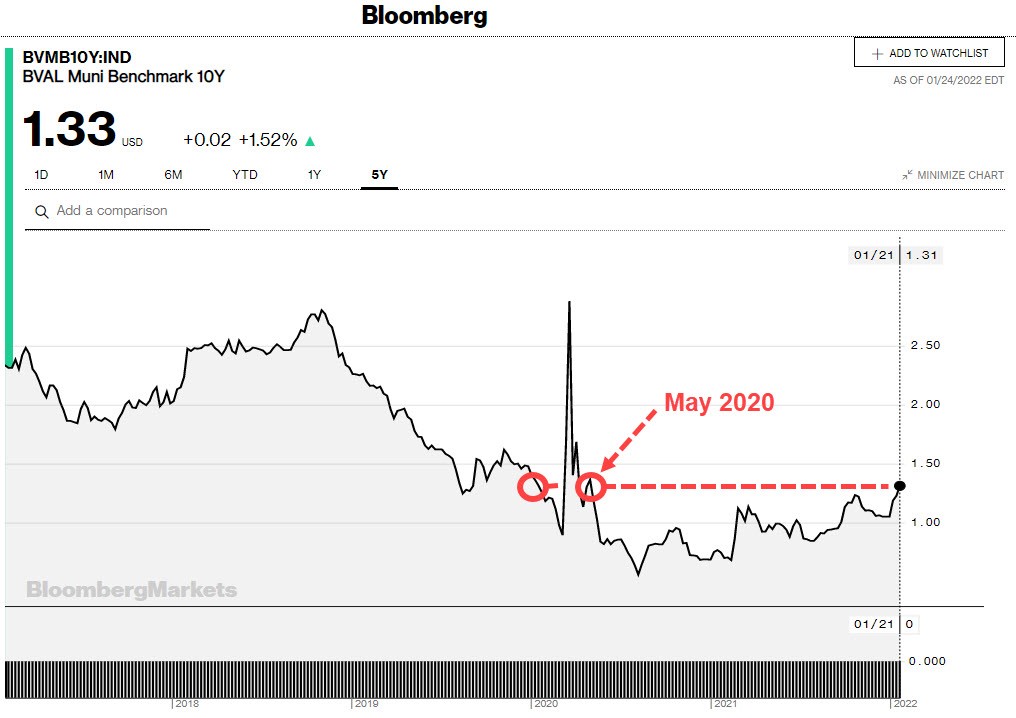

Benchmark 10-year muni yields have risen to their highest level since May 2020. The yield on the 10-year AAA municipal benchmark has risen more than 25 basis points since the start of the year, climbing to 1.33% at the close of January 24th.

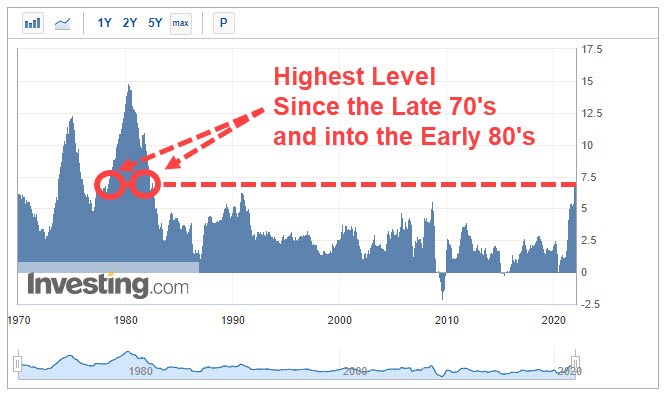

CPI YOY index has hit it highest level since the late 70’s into the early 80’s; some 4 decades ago.

While its too early to say that this yield rise may hold, it most certainly something to keep a very close eye on. Is it time to look at moving your bonds from AFS, to HTM? In any event, get with your Advisor(s) to determine what is best for you.

Consider a first or second opinion from SB Value Partners.

Let SB Value help you examine all these, and other methodologies, to build out your future pathways to optimizing your success.

Questions? So, ASK US HOW. Start a complementary analysis now. It’s a great time to get some additional clarity. Learn some additional truths on the front end. It may position your bank for added improvements in 2022. Listen to what a few thought leaders have to say who have written white papers on the topic at hand. Take a read through a few Fact Sheets on the subject 1. here, 2. here, and 3. here.

As fiduciaries we see quite a lot – in fact we have recently reviewed just under 13,000 data points from Community Financial Institutions – likely just like yours. We look forward to sharing with you some of what we have learned. In the meantime, we thought we would help with some general information that you and your team can consider right away to round out what you are already doing. There is a lot that’s beneficial, starting with cost savings, yield improvements, and likely better balance – even protection. To find out more please click here on our website.