Summary: Bond investors can often use convexity to their advantage, but it is an all-to-often overlooked tool in the volatile market arsenal. Understanding Convexity is a wonderful tool to help assess interest rate risk and to work to best position a portfolio in different rate scenarios — like today’s — and to find pools of potential liquidity within the portfolio.

Today’s market environment is a perfect use-case situation.

Today it still seems like half the market thinks rates will rise, and the other half is already planning for rates to fall. Bond investors can use convexity to their advantage by managing their bond portfolios to take advantage of anticipated changes in interest rates. As an example, and generally, if an investor anticipates rising interest rates they might choose to hold a portfolio of bonds with low convexity, while an investor who anticipates falling interest rates might choose to hold a portfolio of bonds with high convexity. Of course there are many other factors at play and to consider, the point is that convexity should be an important piece of that decision making

A Great Additional Tool To Identify Pools of Liquidity.

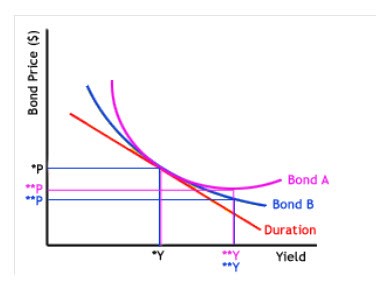

Convexity measures the extent to which a bond and portfolio of bonds is exposed to interest rate changes and thus is key for risk management. It’s a measure of the curvature in the relationship between bond prices and bond yields, calculating the changes in duration of a bond as interest rates change. When a bond’s price is more sensitive to changes in interest rates, it is said to have higher convexity. For example, when interest rates rise, the prices of most bonds tend to fall, and the magnitude of the price decline is typically greater for bonds with higher convexity. Conversely, when interest rates fall, the prices of most bonds tend to rise, and the magnitude of the price increase is typically greater for bonds with higher convexity.

Convexity Visualised

We would be happy to give you a complementary review using our tools on your portfolio. Compare it against the best practices we see, even look for incongruent outliers, and confirm the data you see, or identify new options you may not have considered.

Complementary is great value. Take advantage of it.

At SB Value, we are fiduciaries. Fiduciaries are bound to do what is best for their clients. It really does not get more straight forward than that. We demonstrate to our prospects our value up front with live analysis of their portfolio from many different angles. Take advantage of our SB Value Portfolio Analyses and look to better meet Dodd-Frank and the OCC guidance while striving to improve your performance.

Questions? ASK US HOW to start a complementary comprehensive analysis now from just a few easy to find documents you have readily at hand. It’s a great time to get some additional clarity. Learn some additional truths on the front end. It may position your bank for added improvements into 2023 and into a better positioning for 2024. Listen to what a few thought leaders have to say who have written white papers on the topics at hand. Take a read through a few Fact Sheets and SME articles on the subject that we would be happy to provide.

As fiduciaries we see quite a lot – in fact we have recently reviewed just over 18,000 data points from Community Financial Institutions – likely just like yours. We look forward to sharing with you some of what we have learned over the last three decades. In the meantime, we thought we would help with some general information that you and your team can consider right away to round out what you are already doing. There is a lot that’s beneficial, starting with cost savings, yield improvements, potential risk reduction, and likely better balance – even protection. To find out more please click here or go to our website.