Summary: The Treasury trade is looking very interesting at the moment. You might want to consider it if it fits your strategic plan, liquidity, and shorter-duration security portfolio needs. This trade does not happen very often, and is often not presented because the sale of treasuries do not carry the margins desired by many investment houses.

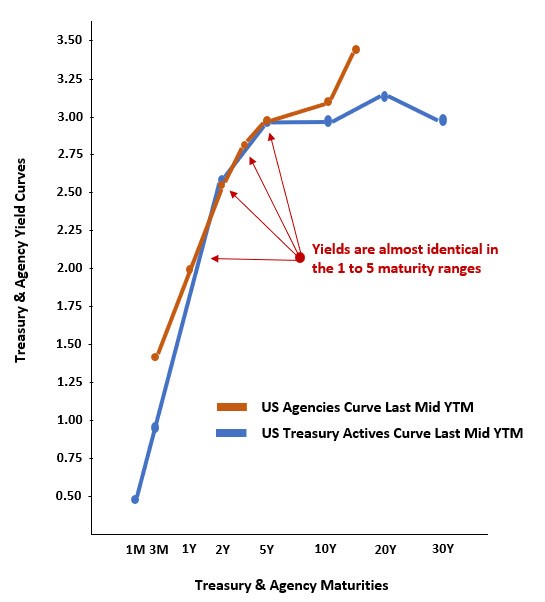

While Agencies are generally considered safe, they are not as safe as the full faith and credit of a US Treasury. As you can see below, if you are looking at buying a bullet between 2 and 5 years, it behooves you to consider buying a US treasury instead. Traditional brokers will more than likely not inform you of this, but as advisors we feel its incumbent for you to know. Below is a side by side view of yields associated with the two, and as you can see, they are usually yielding almost identically between 2 and 5 years. But more importantly, finding a 5 year bullet agency with any significant size is very difficult in this environment adding more reason to consider the Treasury trade instead. As always, we hope this helps.

US Treasury Yield Curve Overlayed to US Agency Yield Curve (April 26, 2022)

As always, consider a first or second opinion from SB Value Partners by eMailing us back today.

Let SB Value help you examine all these, and other methodologies, to build out your future pathways to optimizing your success.

Questions? ASK US HOW to start a complementary analysis now. It’s a great time to get some additional clarity. Learn some additional truths on the front end. It may position your bank for added improvements in 2022 and into a better positioning for 2023. Listen to what a few thought leaders have to say who have written white papers on the topic at hand. Take a read through a few Fact Sheets on the subject that we would be happy to provide.

As fiduciaries we see quite a lot – in fact we have recently reviewed just under 14,000 data points from Community Financial Institutions – likely just like yours. We look forward to sharing with you some of what we have learned. In the meantime, we thought we would help with some general information that you and your team can consider right away to round out what you are already doing. There is a lot that’s beneficial, starting with cost savings, yield improvements, and likely better balance – even protection. To find out more please click here on our website.