FEDERAL OPEN MARKET COMMITTEE (FOMC) MEETING RESULTS:

DATE: June 15 – 16, 2021 | MEETING LOCATION: Virtual

- 1Fed pledges to use full range of tools to assist the economy. Fed does not change rates – keeps interest rate range at 0.0% – 0.25%.

- 2Fed claims that the progress on COVID vaccinations have helped, and the economy is much stronger because of it.

- 3The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.

- 4Fed claims recent inflation is transitory!

ECONOMIC HIGHLIGHTS: The Federal Reserve pledges to do everything in its power to assist the economy.

- “The progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement.

- Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

- The path of the economy will depend significantly on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.”

ANNOUNCEMENTS: Fed funds rate unchanged. Fed funds range remains 0.0% – 0.25%. Fed pledges more bond buying if necessary.

- “The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

- In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.

- These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

- In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.

- The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

- The Board of Governors of the Federal Reserve System voted unanimously to maintain the interest rate paid on required and excess reserve balances at 0.15 percent, effective June 17, 2021.”

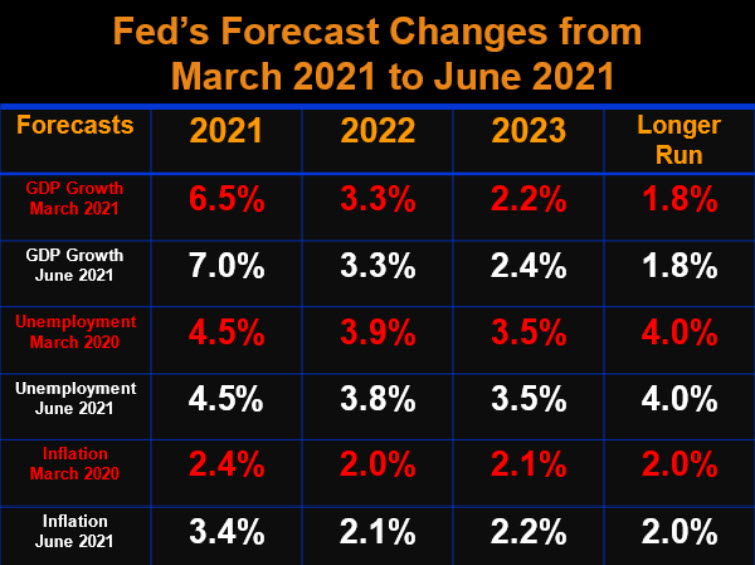

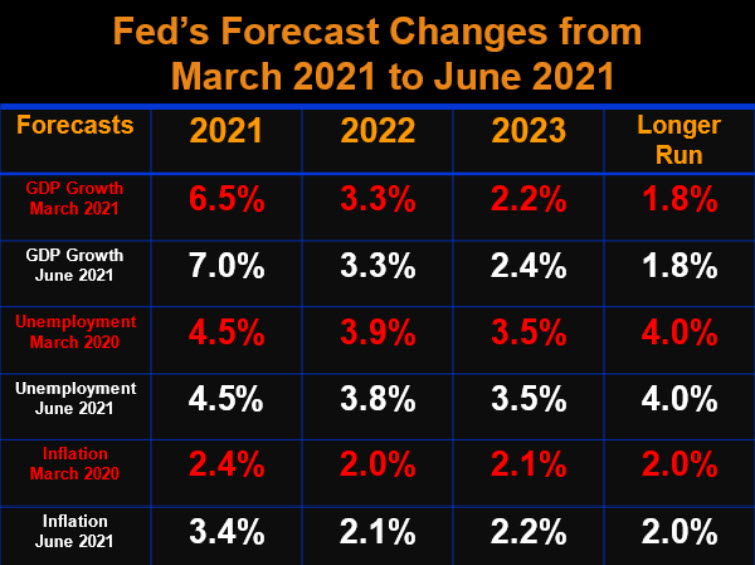

FED’S NEW ECONOMIC PROJECTIONS: The FOMC’s most recent Economic Projections for 2021 are more optimistic than those from the previous forecasts.

- “The new Fed forecast indicates that GDP growth in 2021 will be higher than previously forecasted. The new growth rate is forecast to be 7.0% compared to the earlier forecast of 6.5%.

- The biggest change in the new forecast is on the inflation front. The latest forecast shows over-all Personal Consumption Expenditure (PCE) Index increasing in 2021 to 3.4% compared to the earlier forecast of 2.4%.

- More importantly, The Fed’s newest forecast shows the inflation rate in 2022 to be 2.1% up modestly from the previous forecast of 2.0%. Fed officials have said all along that they believe the current inflation is only transitory, and their 2022 and 2023 forecasts on inflation reflects that view.

VOTING RESULTS: No dissenting votes

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles and Christopher J. Waller.

NEXT MEETING: July 27 – 28, 2021

”

ABOUT THE AUTHOR

Dr. Edmond J. Seifried, PhD

Dr. Seifried is Professor Emeritus of Economics and Business at Lafayette College in Easton, Pennsylvania and Executive Consultant for the Sheshunoff CEO Affiliation Programs.

Dr. Seifried serves as the dean of the Virginia and West Virginia Banking Schools and has served on the faculty of numerous banking schools including: Stonier Graduate School of Banking, and the Graduate School of Banking of the South.