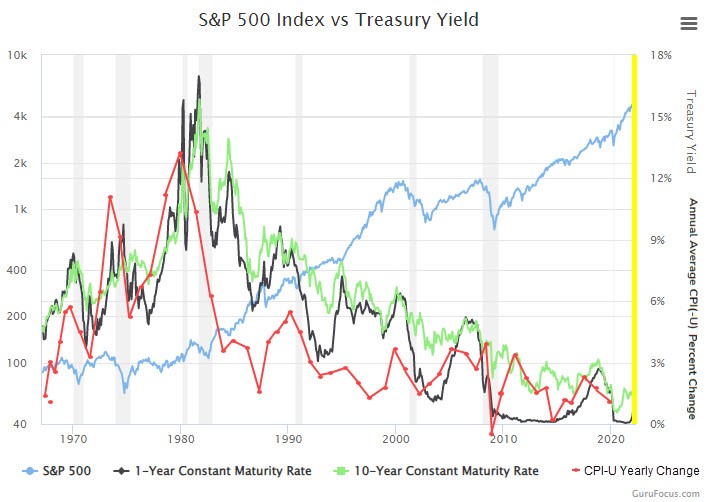

Summary: Some important historical perspective to consider during times of volatility

1. Stocks generally do not do much during high periods of inflation as pressure on profits weight performance

2. Yields tend to generally increase and follow the trend of higher CPI numbers

3. Generally as the CPI decreases, yields tend to follow suit and equities tend to rise

When you look at CPI, treasury yields and equities in one overlayed chart, because the bond markets (aka treasuries) are ten times the size of the equity markets, they tend to be the greatest confirmation of historic moves. As you can see depicted above from a historical perspective, when the CPI rises, generally bonds followed suit thereafter once the ‘markets’ confirmed that higher inflation was here to stay.

In turn, equities, the smaller of the markets and historically the least ‘market’ confirming of the three, finally started to upward trend — that is, once the CPI and the bond ‘market’ started their long downward slide toward 2020. In a nutshell, it behooves all investors not to underestimate the bond market as we believe that it has been the most reliable source of market moving trends.

As always, consider a first or second opinion from SB Value Partners.

Let SB Value help you examine all these, and other methodologies, to build out your future pathways to optimizing your success.

Questions? ASK US HOW to start a complementary analysis now. It’s a great time to get some additional clarity. Learn some additional truths on the front end. It may position your bank for added improvements in 2022. Listen to what a few thought leaders have to say who have written white papers on the topic at hand. Take a read through a few Fact Sheets on the subject 1. here, 2. here, and 3. here.

As fiduciaries we see quite a lot – in fact we have recently reviewed just under 14,000 data points from Community Financial Institutions – likely just like yours. We look forward to sharing with you some of what we have learned. In the meantime, we thought we would help with some general information that you and your team can consider right away to round out what you are already doing. There is a lot that’s beneficial, starting with cost savings, yield improvements, and likely better balance – even protection. To find out more please click here on our website.